RESIDENTIAL BRIDGE LOANS

Low minimum credit score!

No application fee!

"Asset-Based" underwriting

Purchase or Refinance

Close in 3 weeks or less

The Residential Bridge Loan Program offers real estate investors a quick, transparent, and streamlined funding process. Unlike many real estate mortgage loan programs approval is heavily based on the amount of equity in the property and is driven by the assets value instead of a borrowers credit score or income. Just like our Stated Income Mortgage Loan Program, there is no income documentation, no income verification, no tax return; the biggest difference is that there is a low minimum credit score requirement.

FundingPilot is proud to offer some of the most diverse, competitive, and flexible residential mortgage loan program. The Residential Bridge Loan is the best option for real estate investors looking for an underwriting process that is focused on the property instead of your income or credit history. To receive your custom, hassle-free Bridge Loan quote please complete the "QUICK QUOTE" Form or call us directly at 888-860-2844.

Everything you need to know about the Residential Bridge Loan Program:

Loan Amounts: $75,000 - $15,000,000

Interest Rates: 9.5%+

Amortization: Interest-Only

Term: up to 2 years

Payment: Monthly

Loan-to-Value (LTV): ≤ 75%

Credit Score: 500+ FICO

Occupancy: Non-Owner Occupied

Property: Residential Investment

Property Types: SFR, 2-4 Units, Condo, Townhouse, Mixed-Use, Multifamily

Use of Funds: Investment / Business purposes ONLY

Lending Territory: Alabama, Alaska, Arkansas, Colorado, Connecticut, Delaware, Washington D.C., Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin, Wyoming

APPROVAL PROCESS: Residential Bridge Loans

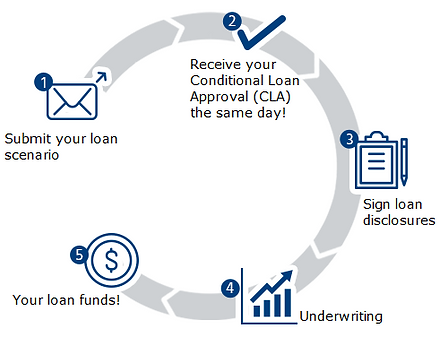

The approval process for a Residential Bridge Loan is streamlined; designed to bypass many of the common obstacles associated with full-documentation mortgage loan programs, hence the ability to close your loan in record time.

Once your dedicated Loan Officer reviews your scenario and confirms your eligibility a Pre-Approval will be issued. It will list the loan amount you qualify for and any documents required to obtain your Conditional Loan Approval (CLA) / Letter of Intent (LOI).

Once the CLA / LOI is issued, it will also outline any conditions needed to clear your loan for funding. To prevent delays, your appraisal and title search will be ordered once we receive your signed disclosures which is very early in the process. The entire funding experience for a Residential Bridge Loan takes roughly 10-15 days from state to finish.

Have a question? Call us at 888-860-2844

ADDITIONAL LENDING PROGRAMS

We're the best at what we do for a reason...

FLEXIBILITY. No more needing to go from bank to bank trying to find small business loans, we cover it all. Whether your credit is strong or poor we have business lending programs to meet your capital needs.

FOCUS. We're 100% focused on small business owners like yourself. We deliver results nationwide and have funding specialists available 6 days per week.

SPEED. We save you lots of time when looking for a small business loan. You answer a few questions and we show you your options. We make getting a small business loan simple and fast.

TRUST. We take care of you every step of the way. Our business lending advisors believe in your business and care about your success. It’s an experience you’ll tell your friends about, guaranteed! Did we mention our A+ rating with the Better Business Bureau?

$794,000 FUNDED!

When a manufacturing company in Pennsylvania needed to meet a large purchase order request they needed funding quickly to meet their demand. Within a matter of 5 business days they were funded and are continuing to leverage our business lending programs to further grow their successful business.

LOAN TYPE: Asset-Based Loan

$28,600 FUNDED!

When a local bakery / cafe was in need of some working capital FundingPilot was able to step in and get their business $28,600 in under 48 hours!

LOAN TYPE: Merchant Cash Advance

$225,000 FUNDED!

Mark & Samantha needed to renovate their location but couldn't qualify for a commercial renovation loan, nor most business loans due to credit score blemishes. By using an investment property they owned as collateral we were able to fund them $225,000 in 9 days.

LOAN TYPE: Secured Business Loan

FundingPilot is making waves! Just a few places you'll find us: